- How to Begin Trading with the Exness Web Terminal

- Key Features of the Exness Web Terminal

- Optimizing Your Exness Web Terminal Experience

- Efficient Trading on the Exness Web Terminal

- Advanced Trading Strategies for Exness Web Terminal

- Implementing Strategies on Exness Web Terminal

- Exness Web Terminal: Simplified Web-Based Trading

- Exness Web Terminal: Features Overview

- Exness MT4 and MT5 Web Terminals: A Detailed Comparison

- FAQ

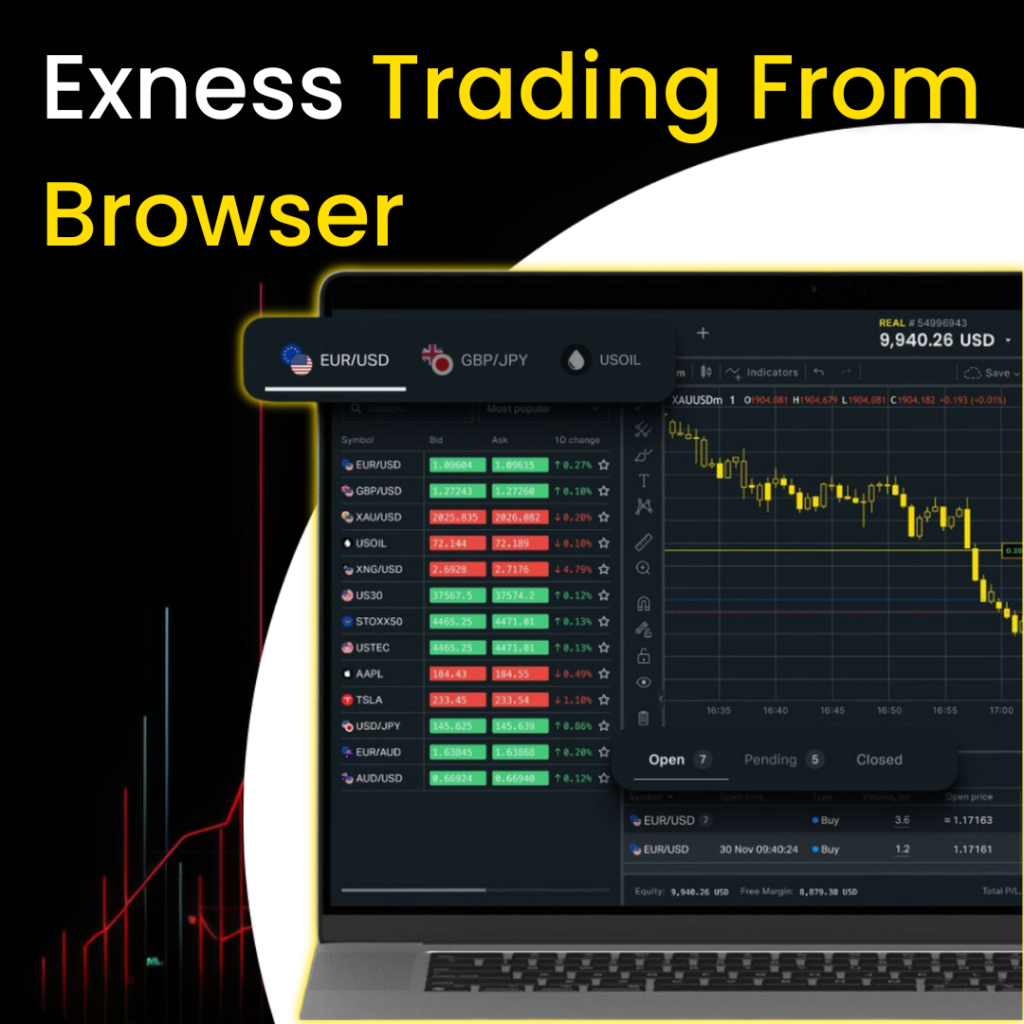

The Exness Web Terminal offers a seamless trading experience directly through your web browser, eliminating the need for any software downloads or installations. It’s ideal for traders seeking a clean and easy-to-use interface while still having access to essential trading tools.

How to Begin Trading with the Exness Web Terminal

Accessing the Web Terminal:

- Visit the official Exness website.

- Navigate to the ‘Trading’ section and select the Web Terminal option.

Logging In:

- Head to the Exness Web Terminal login page.

- Enter your trading account credentials. If you don’t have an account, you can easily sign up on the Exness homepage.

Getting Familiar with the Interface:

- After logging in, take a moment to explore the layout. Understanding where key features are located will help streamline your trading activities.

Setting Up Your Trading Dashboard:

- Customize your charts and add the tools or indicators you use frequently for a personalized trading experience.

Funding Your Trading Account:

- Make sure your account is funded by making a deposit through your Exness Personal Area.

Placing Trades:

- Use the platform’s tools to analyze the market, select your preferred instruments, and set order types. Don’t forget to implement risk management strategies such as stop loss and take profit to optimize your trades.

Key Features of the Exness Web Terminal

User Interface:

- Simplified Design: The Exness Web Terminal features a clean, intuitive interface, making it user-friendly for both new and seasoned traders.

- No Installation Needed: Access the terminal directly through your web browser, providing flexibility and convenience without the need for downloads.

Trading Features:

- One-Click Trading: Make trades instantly with one-click functionality, which is especially useful for capturing fast market movements.

- Real-Time Price Updates: Stay informed with real-time quotes across all available instruments, ensuring you’re always aware of market changes.

Tools and Resources:

- Advanced Charting Tools: Take advantage of a variety of charting options and technical indicators to perform detailed market analysis.

- Economic Calendar Integration: Keep track of important economic events that may affect market volatility.

Security:

- Secure Access: Your login credentials and transaction data are protected by SSL encryption.

- Privacy Protection: Your personal and financial information remains secure at all times.

Device Compatibility:

- Cross-Platform Access: The Web Terminal works on PCs, tablets, and smartphones, providing a consistent experience across different devices.

Support:

- Comprehensive Assistance: Traders can easily access help through the platform whenever needed.

Optimizing Your Exness Web Terminal Experience

To make the most of the Exness Web Terminal, you should tailor it to fit your trading needs.

1. Customizing the Interface:

- Layout Adjustments: Organize your terminal so key features, such as charts and order books, are easily accessible. This will streamline your workflow and make trading more efficient.

- Chart Customization: Choose your preferred chart types—candlestick, bar, or line—and personalize colors and styles for better market visibility.

2. Using Technical Tools and Indicators:

- Adding Indicators: Equip your charts with popular technical indicators like Moving Averages or MACD, adjusting their settings to match your trading strategy.

- Graphical Tools: Utilize tools like Fibonacci retracements and trend lines to identify price movements and potential trade entry or exit points.

3. Setting Up Trading Preferences:

- Trade Settings: Customize your trading preferences, such as default lot sizes, leverage, and stop loss/take profit levels. This will speed up your trading process and improve efficiency.

- Alerts Setup: Set up alerts for key price levels or significant market events to stay informed without having to constantly monitor your trades.

Efficient Trading on the Exness Web Terminal

Placing a Trade:

- Select Your Instrument: Choose a financial instrument from the Market Watch or directly from the chart.

- Opening an Order: Click ‘New Order,’ enter your trade details (volume, stop loss, take profit), and confirm by selecting ‘Buy’ or ‘Sell.’

Managing Pending Orders:

- Setting Pending Orders: Choose a pending order type (e.g., Buy Limit or Sell Limit) and set the price trigger.

- Customizing Orders: Define trade volume and other parameters such as stop loss or take profit.

- Order Activation: The order will automatically execute when the specified market conditions are met.

Modifying and Closing Orders:

- Adjusting Orders: Navigate to the ‘Trade’ tab, right-click the order, and choose ‘Modify or Delete Order’ to update your settings.

- Closing Orders: To finalize a trade, right-click the trade in the ‘Trade’ tab and select ‘Close Order.’

The Exness Web Terminal offers a user-friendly yet powerful platform that allows traders to manage trades efficiently. By customizing the interface and integrating key technical tools, you can enhance your trading strategies and make the most of the web-based platform from anywhere with an internet connection.

Advanced Trading Strategies for Exness Web Terminal

The Exness Web Terminal offers a flexible and user-friendly web-based platform for executing trades and analyzing markets without the need for software installations. To take full advantage of the platform’s capabilities, it’s important to apply advanced trading strategies using its real-time data, customizable charts, and integrated tools. Below are several detailed strategies to help you elevate your trading game on the Exness Web Terminal.

1. Trend Following Strategy

Setup:

The trend-following strategy focuses on trading in the direction of a market’s long-term trend. With the Exness Web Terminal, you can use technical indicators like Moving Averages (SMA, EMA) and the MACD (Moving Average Convergence Divergence) to identify the market’s overall direction.

- Moving Averages (SMA or EMA): These indicators smooth price data over time to highlight market trends. A rising SMA indicates an uptrend, while a falling SMA signals a downtrend.

- MACD: This indicator compares two moving averages and shows momentum. A MACD line crossing above the signal line suggests a bullish trend, while crossing below signals a bearish trend.

Action:

In an uptrend, enter buy trades when the price pulls back toward the moving average (acting as support). In a downtrend, open sell positions when the price pulls back toward resistance.

Management:

Effective risk management is critical in this strategy. Use stop-loss orders below support levels in uptrends and above resistance in downtrends. Trailing stops can help lock in profits as the trend progresses.

Example:

On the Exness Web Terminal, set the SMA to a 50-period to identify a long-term trend. During an uptrend, if the price approaches the 50-SMA, consider entering a buy trade, placing your stop loss just below the moving average.

2. Range Trading Strategy

Setup:

Range trading involves identifying assets that fluctuate between support (low) and resistance (high). You can use Bollinger Bands or the Stochastic Oscillator on the Exness Web Terminal to spot these ranges.

- Bollinger Bands: The bands show volatility, with the middle line being a moving average. The price hitting the lower band suggests oversold conditions, while touching the upper band implies overbought conditions.

- Stochastic Oscillator: This tool compares the current closing price to its range over a period and helps identify overbought or oversold levels.

Action:

Buy at support when the price is oversold, and sell at resistance when the price is overbought. For example, when the price hits the lower Bollinger Band and the Stochastic Oscillator shows oversold conditions, it may be time to buy.

Management:

Place stop-loss orders outside the range to protect against breakouts. Use take-profit orders near the range’s opposite boundary to secure profits.

Example:

If a stock trades between $100 (support) and $120 (resistance), and the price hits $100 while Bollinger Bands suggest oversold conditions, you could open a buy order with a stop loss set at $98 and a take profit at $118.

3. Scalping Strategy

Setup:

Scalping is a high-frequency trading strategy that focuses on making numerous small trades to capture quick price movements. The Exness Web Terminal, with real-time data and fast execution, is ideal for this.

- Real-Time Quotes: Scalping relies on immediate price updates, and the Exness Web Terminal provides this functionality.

- Short Time Frames: Use 1-minute or 5-minute charts to monitor price fluctuations closely.

Action:

Scalpers aim to make small profits on each trade. In highly liquid markets with low spreads, quickly enter and exit positions to accumulate gains throughout the day.

Management:

Tight stop-loss orders are necessary for scalping, as market movements can quickly reverse. Set small take-profits to lock in gains.

Example:

On a 1-minute chart, if you notice small upward ticks on a currency pair, open a buy position during an upward tick and close it a few pips higher. Repeat this multiple times for cumulative gains.

4. News Trading Strategy

Setup:

News trading leverages significant price movements that follow major economic releases or geopolitical events. The Exness Web Terminal’s economic calendar helps traders stay aware of these events.

- Economic Calendar: Use it to track upcoming events like central bank announcements, GDP reports, or political developments that could drive market volatility.

Action:

Before a major event, analyze market sentiment and decide whether to trade before or after the news. For example, if strong GDP growth is expected, consider entering a long position on the relevant currency pair.

Management:

News events cause significant price swings, so using wider stop-losses to accommodate volatility is crucial. Limit orders can control your entry price in volatile conditions.

Example:

If a central bank is set to announce an interest rate decision, you could enter a trade based on your expectations. For example, a buy position on a currency pair if a rate hike is anticipated. Set a wider stop-loss to manage potential volatility.

Implementing Strategies on Exness Web Terminal

Integration with Tools:

The Exness Web Terminal offers a variety of charting tools, technical indicators, and customizable features to implement these strategies effectively.

- Technical Indicators: Add indicators like MACD, RSI, and Bollinger Bands to your charts for enhanced analysis.

- Customization: Adjust chart layouts and indicator settings to suit your trading strategy and style.

Risk Management:

Regardless of the strategy you choose, effective risk management is essential. Always keep a balanced risk-reward ratio, use stop-loss orders, and only trade with leverage that aligns with your risk tolerance.

- Leverage Management: Use leverage wisely, understanding that higher leverage can magnify both gains and losses.

Continuous Learning:

Markets evolve, and so should your strategies. Regularly assess market conditions, keep up with global economic news, and analyze your past trades to refine your approach.

Exness Web Terminal: Simplified Web-Based Trading

The Exness Web Terminal offers traders a streamlined, browser-based trading experience, eliminating the need for downloads or installations. This platform is ideal for those who prefer a clean and intuitive interface while still accessing essential tools for successful trading.

Getting Started with the Exness Web Terminal

Accessing the Platform:

- Navigate to the Exness website and select the Web Terminal option from the ‘Trading’ section.

Logging In:

- Use your existing Exness account credentials to log in. If you’re new to Exness, you can easily sign up on the homepage.

Exploring the Interface:

- Once logged in, familiarize yourself with the terminal’s layout. Understand where key features like charts and order options are located to improve your trading efficiency.

Customizing Your Trading Setup:

- Adjust charts, indicators, and other tools according to your preferences. Personalizing your setup can make trading smoother and more effective.

Funding Your Account:

- Ensure your account is funded by making deposits via your Exness Personal Area.

Executing Trades:

- Analyze the markets, select your instruments, and place trades using the available tools. Don’t forget to apply risk management strategies like stop losses and take profits.

Exness Web Terminal: Features Overview

User Interface:

- Intuitive Design: The Exness Web Terminal offers a simple, user-friendly layout, accessible to traders at all experience levels.

- No Downloads Needed: You can trade directly from your browser, without any additional software.

Trading Capabilities:

- One-Click Trading: Execute trades quickly with one-click functionality, ideal for seizing fast market opportunities.

- Real-Time Data: Access live price updates for all instruments, ensuring you stay informed of market changes.

Tools and Resources:

- Advanced Charting Tools: Perform detailed market analysis using a variety of charting options and technical indicators.

- Integrated Economic Calendar: Stay updated on key economic events that could affect market conditions.

Security:

- SSL Encryption: The platform ensures that all data, including login details and transactions, is securely encrypted.

- Data Privacy: Your personal and financial information is protected at all times.

Cross-Platform Access:

- Device Compatibility: The Exness Web Terminal works on any device, allowing you to trade from your computer, tablet, or smartphone with no performance issues.

Customer Support:

- Accessible Help: In-platform support ensures you receive assistance whenever necessary.

Optimizing Your Trading on the Exness Web Terminal

To maximize efficiency, it’s important to tailor the platform to your trading style and strategies.

- Customizing the Interface:

- Adjust the layout to prioritize the tools you use most, such as charts or order books. Personalization improves workflow and speed.

- Change chart types (candlestick, bar, line) and styles to enhance visibility and market analysis.

- Using Technical Tools and Indicators:

- Add commonly used indicators like Moving Averages or MACD. You can also modify their settings to match your specific trading approach.

- Use graphical tools like trend lines and Fibonacci retracements for analyzing price movements.

- Setting Up Trading Preferences:

- Configure default trade settings like lot size and stop-loss levels to save time and increase efficiency.

- Set alerts for important price levels, so you don’t have to constantly monitor the screen.

Exness MT4 and MT5 Web Terminals: A Detailed Comparison

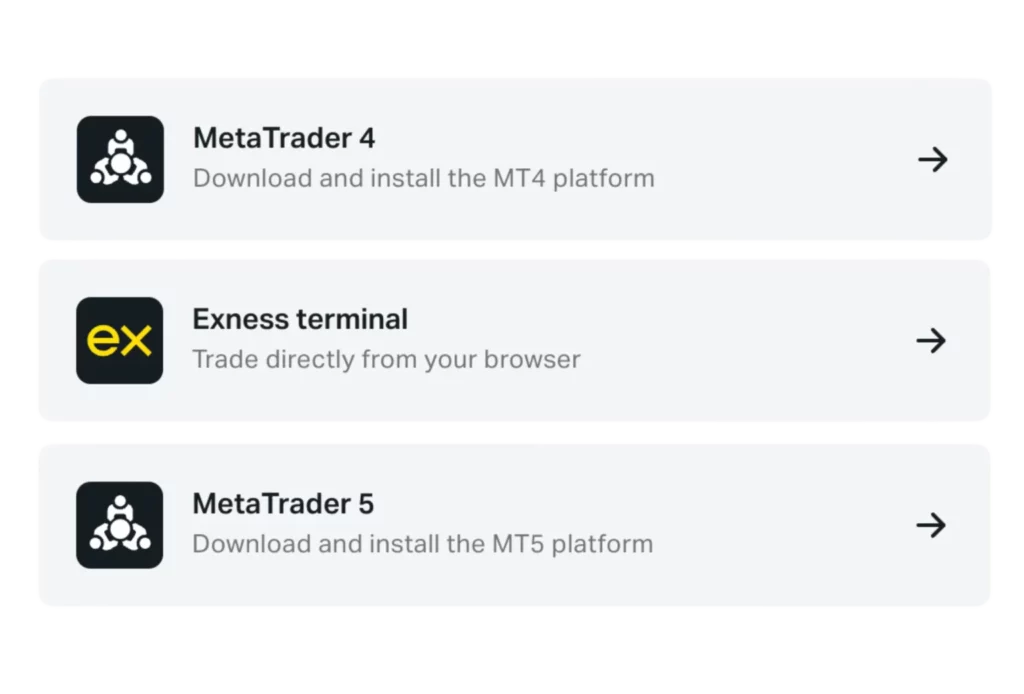

Exness provides both MT4 and MT5 Web Terminals, offering a powerful browser-based trading experience. Here’s an in-depth comparison to help you decide which platform suits your needs.

Exness MT4 Web Terminal

Overview: The MT4 Web Terminal provides the full functionality of MetaTrader 4 without the need for downloads, making it ideal for traders who want quick access and mobility.

Key Features:

- Full MT4 Experience: Includes real-time quotes, live charting, and quick trade execution.

- One-Click Trading: Ideal for high-frequency traders.

- Comprehensive Analysis Tools: Access to a wide range of technical indicators and timeframes for effective market analysis.

Exness MT5 Web Terminal

Overview: The MT5 Web Terminal offers an upgraded trading experience with advanced features tailored to professional traders looking for more sophisticated tools.

Key Features:

- Advanced Order Types: Includes Buy Stop Limit and Sell Stop Limit for more flexible order management.

- Expanded Charting Tools: More timeframes, indicators, and graphical tools than MT4.

- Economic Calendar: A built-in feature that informs traders about upcoming market events.

- Multi-Asset Trading: Access to a broader range of instruments, including Forex, stocks, futures, and cryptocurrencies.

Comparing Exness Web Terminals with Other Platforms

- Accessibility:

- Exness Web Terminals: Both MT4 and MT5 are accessible from any device with a web browser, ensuring flexibility and ease of use without software downloads.

- Other Platforms: Some web-based platforms lack the seamless integration and accessibility provided by Exness.

- Functionality:

- Exness Web Terminals: These offer full functionality, including all the tools and features of the desktop versions.

- Other Platforms: Some competitors’ web terminals may limit the features available, making it harder to perform in-depth analysis.

- User Experience:

- Exness Web Terminals: Designed for ease of use, the interfaces cater to both novice and professional traders.

- Other Platforms: User experience can vary, with some platforms being harder to navigate, especially for new traders.

- Performance:

- Exness Web Terminals: Optimized for smooth performance with minimal latency, though performance may depend on internet connectivity.

- Other Platforms: Some web-based platforms struggle with stability during high market volatility.

MT4 vs. MT5 Web Terminals: Key Differences

| Feature | MT4 Web Terminal | MT5 Web Terminal |

| Timeframes | 9 timeframes available | 21 timeframes for more flexibility |

| Order Types | 4 pending order types | 6 pending order types, including Stop Limit orders |

| Depth of Market | Not available | Available for more detailed market insights |

| Economic Calendar | Not available | Integrated directly into the platform |

| Technical Indicators | 30 built-in indicators | 38 built-in indicators |

| Assets | Forex, metals, indices, energies | Forex, stocks, indices, futures, cryptocurrencies |

Conclusion

The Exness Web Terminal, in both MT4 and MT5 versions, offers traders a comprehensive and accessible web-based trading experience. Whether you’re a beginner or a seasoned trader, these platforms provide the tools, functionality, and convenience needed to execute successful trades from any internet-enabled device. The MT5 Web Terminal offers more advanced features, making it an ideal choice for traders seeking deeper market analysis and a broader range of instruments, while the MT4 Web Terminal remains a go-to option for traders preferring simplicity and proven performance.

FAQ

What is the Exness Web Terminal?

The Exness Web Terminal is a web-based trading platform that allows users to trade financial markets directly from their web browser without needing to download or install any software. It offers access to essential trading tools and real-time market data.