When beginning your trading experience with Exness, it’s essential to understand the financial requirements, especially the initial deposit. This guide provides clarity on Exness’s deposit policies to help new traders confidently begin their journey.

Overview of Exness Deposit Requirements

Exness offers a flexible deposit structure based on the type of account and your geographic location. This adaptable approach ensures that both novice and experienced traders can engage in the markets according to their financial capacity and trading goals.

- Standard Accounts: Perfect for beginners, the Standard account can require as little as $1 for the initial deposit in certain regions. This low entry point allows new traders to enter the financial markets without significant financial pressure.

- Professional Accounts: For more advanced traders, Exness offers Pro, Zero, and Raw Spread accounts, which typically require a minimum deposit of $200. These accounts provide enhanced trading conditions, such as tighter spreads, making them ideal for high-volume or frequent traders.

This flexible deposit structure allows traders to choose an account that best matches their financial situation and trading objectives, making Exness a versatile option for traders at all levels.

Exness Deposit Conditions and Policies

Exness is known for its competitive deposit conditions, designed to help traders efficiently manage their funds. Below are some key features of Exness’s deposit services:

- Currency Conversion: While Exness does not charge deposit fees, be aware of potential currency conversion costs. If you deposit in a currency different from your account’s base currency, a conversion will occur at competitive rates, but keep an eye on exchange rate fluctuations.

- Instant Processing: Most deposits through electronic methods, such as credit cards and e-wallets, are processed instantly. This is critical for traders needing quick access to funds to take advantage of fast-moving market conditions.

- Transparency: Exness ensures full transparency regarding fees. While Exness itself does not charge deposit fees, third-party providers, such as banks or payment processors, may apply fees.

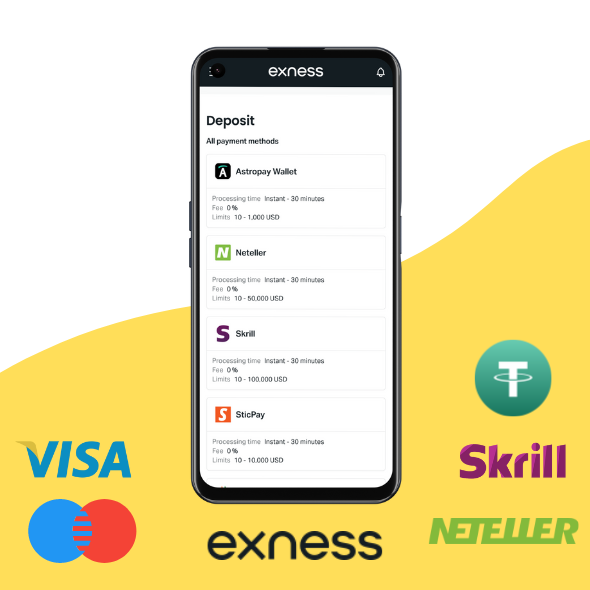

- Variety of Payment Methods: To accommodate traders globally, Exness supports multiple payment methods, including bank transfers, credit/debit cards, and popular e-wallets like Neteller, Skrill, and WebMoney. This wide variety provides traders with flexible and convenient deposit solutions.

By offering a comprehensive and flexible deposit framework, Exness simplifies the process of funding your trading account, helping you focus on your trading goals with minimal obstacles.

Getting Started with Exness

Starting your trading journey with Exness is simple and user-friendly. Here’s a step-by-step guide to help you begin:

- Account Registration

- Sign Up: Visit the Exness website and fill out the registration form with your personal information, including your name, email, and phone number.

- Verification: To comply with regulations and secure your account, you’ll need to verify your identity. This involves submitting documents such as a passport or driver’s license, as well as proof of address.

- First Deposit

- Choose Deposit Amount: Based on your chosen account, deposit the required minimum. Standard accounts may have a starting deposit as low as $1, while professional accounts require a minimum of $200.

- Select Payment Method: Exness offers various deposit options, including bank transfers, credit cards, and e-wallets. Choose the method most convenient for you.

- Complete the Transaction: Follow the instructions to complete your deposit. Most methods process deposits instantly, allowing you to start trading right away.

- Begin Trading

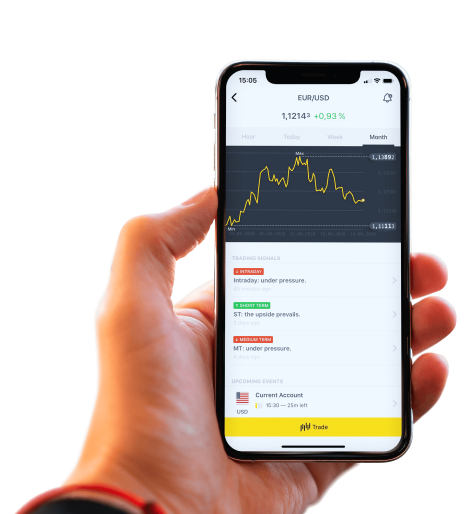

- Access Trading Platforms: Once your account is funded, you can use Exness’s advanced trading platforms, including MetaTrader 4 and MetaTrader 5.

- Explore Market Opportunities: Start trading in forex, commodities, indices, or cryptocurrencies with Exness’s diverse range of trading instruments.

- Utilize Tools and Resources: Take advantage of Exness’s educational materials, analytical tools, and customer support to enhance your trading experience.

Ensuring a Strong Start

- Educational Resources: Exness offers extensive learning materials such as webinars, tutorials, and articles to help you understand market movements and develop effective trading strategies.

- Demo Account: For beginners, the demo account is an invaluable resource. It allows you to practice trading with virtual funds and get familiar with the platform before risking real money.

- Setting Realistic Goals: Define your trading objectives early on. Whether you aim to achieve consistent profits or learn new trading techniques, having clear goals will help guide your progress.

Long-Term Trading Success

- Staying Informed: Stay updated on market trends and financial news. Exness provides real-time market insights and analyses, helping you make informed trading decisions.

- Risk Management: Employ strong risk management strategies, such as setting stop-loss orders and adjusting your trade size to align with your risk tolerance.

By following these steps and leveraging the resources offered by Exness, you can set yourself up for long-term success in trading. Exness’s commitment to transparency and support makes it an excellent choice for traders at all levels.

Funding Options and Costs at Exness: Detailed Breakdown

Exness provides a broad array of deposit options to suit its global customer base, enhancing convenience and accessibility. This guide explores the available deposit methods and explains the fee structure, ensuring traders manage their funds effectively.

Deposit Methods at Exness

Exness offers a variety of deposit options to meet the diverse needs of its clients:

- Local Bank Transfers: Widely accessible and fast, local bank transfers allow traders to avoid currency exchange issues while enjoying faster processing times.

- Prepaid Cards: For traders who prioritize privacy or prefer not to use their bank accounts, Exness offers prepaid card options for secure, anonymous transactions.

- Mobile Payments: Exness supports mobile payment methods in certain regions, offering convenience for traders who prefer to manage their funds on the go.

- Region-Specific Payment Systems: Exness integrates payment methods specific to different regions, making it easy for local traders to deposit funds using their preferred systems.

- No Maximum Deposit Limit: Exness allows unrestricted deposits, making it suitable for both high-volume traders and beginners. Minimum deposits can start from as low as $1, providing accessibility to all.

Deposit Fees at Exness

Exness maintains a transparent and cost-effective deposit structure, with no internal fees charged by the broker. However, traders may face external costs:

- Third-Party Fees: Certain banks or payment processors may apply their own fees, independent of Exness.

- Currency Conversion: Depositing in a currency different from your account’s base currency may incur a conversion fee charged by the payment provider.

Additional Deposit Information

- Currency Conversion: Be mindful of conversion fees if your deposit currency differs from your account base currency.

- Minimum Deposit Requirements: These may vary depending on your location and payment method.

- Security Protocols: Exness uses advanced security measures to protect all transactions, with additional verification required for certain deposit methods.

Processing Times for Deposits

- Instant Deposits: Most electronic payment methods process deposits instantly, allowing you to begin trading immediately.

- Bank Transfers: May take several business days to process, depending on the banks involved.

- Cryptocurrency Deposits: Generally processed quickly, though the time may vary based on network activity.

By understanding these deposit options and associated costs, traders can efficiently manage their Exness accounts and be ready to capitalize on market opportunities quickly.

FAQ

1. What currencies can I use for my Exness trading account?

Exness offers a wide range of account currency options, including major global currencies like USD, EUR, and GBP, commodity-linked currencies like AUD and CAD, emerging market currencies such as CNY and BRL, and even cryptocurrencies like Bitcoin and Ethereum.