- What is the Exness Investment Calculator?

- Key Components of the Calculator

- Advantages of Using the Exness Investment Calculator

- How to Access the Exness Investment Calculator

- Interpreting the Results from the Exness Investment Calculator

- Exness Investment Calculator: A Comprehensive Tool for Traders

- Example: Using the Exness Investment Calculator

- Exness Calculator vs. Traditional Methods

- Integrating the Exness Calculator into Your Investment Strategy

- FAQs About the Exness Investment Calculator

The Exness Investment Calculator is a powerful feature that provides traders with critical insights to forecast the potential outcomes of their trades. This tool helps enhance profitability, reduce risks, and refine trading strategies. It’s recommended to combine this calculator with personal analysis to ensure sound trading decisions. Whether you’re an experienced trader or just starting, this calculator plays a crucial role in effective portfolio management.

What is the Exness Investment Calculator?

The Exness Investment Calculator is an integrated tool that allows traders to estimate potential returns and profits from their investments. It enables users to simulate various trading scenarios and provides valuable insights before executing real trades. This tool is ideal for developing strategies, managing risks, and optimizing investments.

Key Components of the Calculator

- Profit Calculator

- Function: Calculates potential profit or loss based on variables like entry and exit prices, trade size, and selected currency pairs.

- Usage: Input buy and sell prices along with trade size to calculate profit or loss, accounting for spreads and fees.

- Forex Calculator

- Function: Helps calculate currency trading-related metrics such as conversions and margin requirements.

- Usage: Enter currency pair, account currency, trade size, and leverage to calculate margin, pip value, and profit or loss.

- Leverage Calculator

- Function: Assists traders in understanding how leverage affects their trades, increasing both potential gains and losses.

- Usage: Input capital amount, leverage ratio, and position value to calculate exposure and margin.

- Trading Calculator

- Function: Provides an overall view by incorporating data from the profit, forex, and leverage calculators.

- Usage: Enter instrument type, lot size, and leverage to calculate margins, pip value, and potential outcomes.

Advantages of Using the Exness Investment Calculator

- Risk Management: Offers precise calculations on trade risks, allowing traders to keep exposure within their risk tolerance.

- Strategy Development: Helps in setting entry and exit points, returns, and stop-loss levels.

- Financial Optimization: Enables traders to maximize returns by balancing leverage effectively.

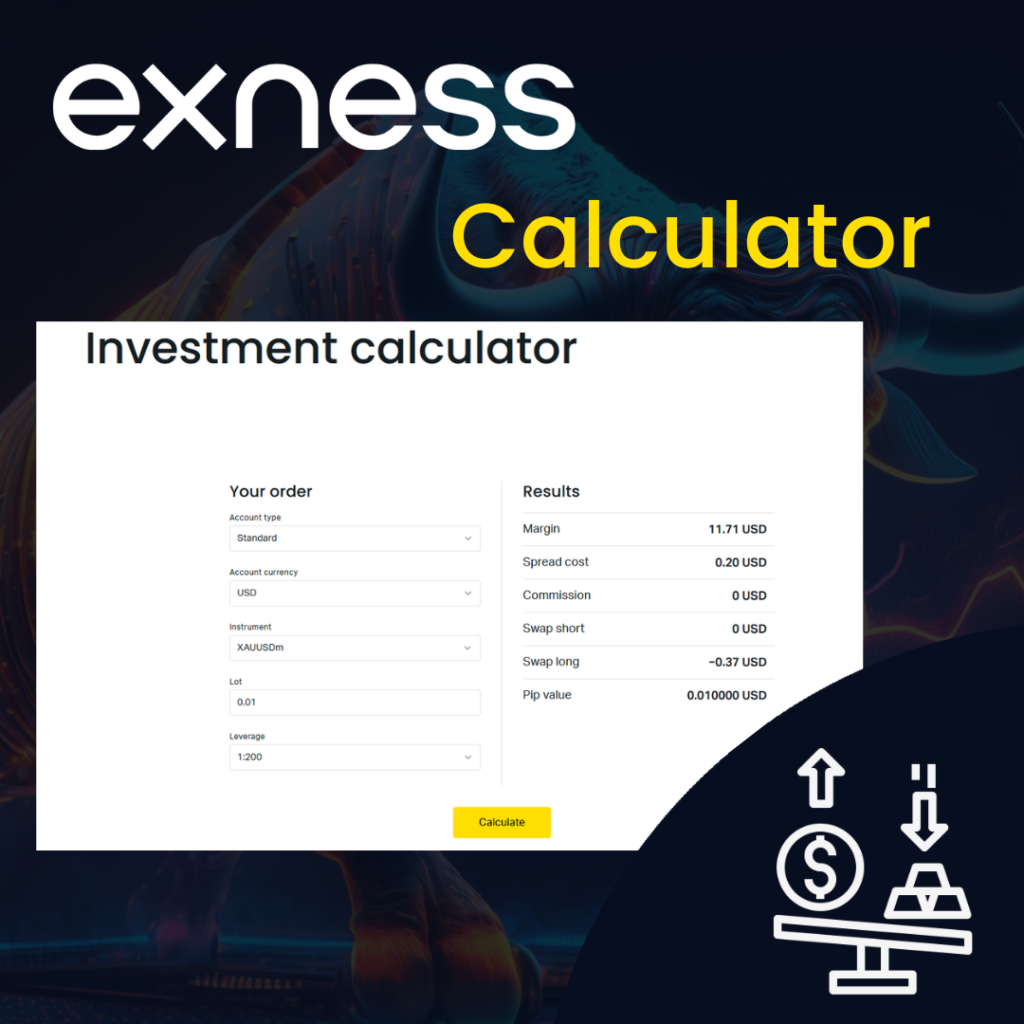

How to Access the Exness Investment Calculator

You can find the Exness Investment Calculator on the Exness website under the ‘Tools’ section. Simply log in to your account, ensuring that calculations reflect your trading conditions.

Using the Exness Investment Calculator

This tool is essential for analyzing trades, fine-tuning strategies, and managing risk. Here’s how to use its various features:

1. Select Account Type and Trading Instrument

- Account Type: Select your account type (e.g., Standard, Pro) to ensure accurate results based on your trading conditions.

- Trading Instrument: Choose your trading instrument (e.g., forex, commodities, cryptocurrencies) to simulate real trading scenarios accurately.

2. Input Position Size, Entry Price, and Leverage

- Position Size: Enter the number of units or lots to be traded. Larger sizes amplify both profit potential and risk.

- Entry Price: Set your planned entry point based on your market analysis.

- Leverage: Input the leverage you plan to use, noting that higher leverage magnifies both potential gains and losses.

3. Choose Account Currency

- Choose your account’s base currency to ensure accurate results, especially when trading currency pairs that involve conversion rates.

Interpreting the Results from the Exness Investment Calculator

1. Margin Requirements and Leverage Impact

- Margin: Shows how much capital is needed to open and maintain positions.

- Leverage: Displays how leverage affects exposure and margin requirements, helping traders balance potential gains with risk.

2. Spread Costs and Commissions

- Spread Cost: Reveals the cost paid to enter a trade, particularly important for high-frequency traders.

- Commissions: Displays any additional fees that may apply to certain trades or account types.

3. Swaps and Holding Costs

- Swaps: Calculates overnight interest fees, essential for traders holding positions long-term.

- Holding Costs: Determines the total cost of maintaining a position over time.

4. Pip Value

- Pip Value: Indicates the impact of each price movement, helping traders set effective stop-loss and take-profit orders.

Benefits of Using the Exness Investment Calculator

- Accurate Risk Assessment

Understand and manage trade risks by calculating exposure and potential losses. - Informed Strategy Development

Plan your trades meticulously by simulating different market conditions and outcomes. - Optimized Financial Performance

Use the tool to maximize your returns while keeping leverage and risks in check.

The Exness Investment Calculator is an indispensable resource for traders aiming to refine their trading approach. By carefully analyzing each component, traders can make more informed decisions, boost profitability, and manage risks efficiently. Whether you are a new trader or a seasoned investor, this tool provides the financial insights you need for more effective trading.

Exness Investment Calculator: A Comprehensive Tool for Traders

The Exness Investment Calculator is an essential resource that helps traders estimate potential trade outcomes, manage risks, and refine trading strategies. By simulating various trading scenarios, traders can better anticipate profits and losses. Although it’s a powerful tool, it should be combined with personal analysis for well-informed trading decisions.

What is the Exness Investment Calculator?

The Exness Investment Calculator is a feature that allows traders to forecast potential returns and profits based on various inputs like entry/exit prices, trade size, and leverage. It enables users to test different scenarios, making it easier to manage risk, optimize asset allocation, and improve trading strategies.

Key Components of the Calculator

- Profit Calculator

- Function: Calculates potential profit or loss based on entry and exit prices, position size, and applicable fees.

- Usage: Input buy/sell prices and trade size to get an immediate profit/loss estimate, considering spreads and commissions.

- Forex Calculator

- Function: Computes important metrics like currency conversions and margin requirements for forex trades.

- Usage: Enter trade details to view margin requirements, pip value, and potential outcomes for currency pairs.

- Leverage Calculator

- Function: Shows the impact of leverage on trade exposure, including potential profits and losses.

- Usage: Input capital, leverage ratio, and trade size to understand the full exposure and required margin.

- Trading Calculator

- Function: Offers a holistic overview by combining profit, forex, and leverage calculations.

- Usage: Input trade details (instrument, price, lot size, leverage) to get detailed information about margins, pip value, and potential risks.

Advantages of Using the Exness Investment Calculator

- Risk Management: Helps traders accurately calculate trade risks, keeping exposure within acceptable limits.

- Strategic Planning: Aids in setting precise entry/exit points and expected returns.

- Financial Optimization: Balances the potential for higher returns with the risks of leveraging, allowing for more effective capital management.

How to Access the Exness Investment Calculator

The calculator is available under the tools section on the Exness website. Simply log into your account to use it, ensuring all results are tailored to your trading conditions.

Using the Exness Investment Calculator

The calculator is designed to help traders analyze potential trades, refine strategies, and manage risk. Here’s how to use its key features:

1. Select Account Type and Trading Instrument

- Account Type: Choose the correct account type (e.g., Standard, Pro) to reflect your trading conditions.

- Trading Instrument: Select the asset you’re trading (e.g., forex pairs, commodities) to simulate real-world scenarios.

2. Input Position Size, Entry Price, and Leverage

- Position Size: Input the number of units or lots for your trade. Larger sizes amplify both risks and potential returns.

- Entry Price: Set your expected entry point.

- Leverage: Choose your leverage ratio, noting that higher leverage increases both profit potential and risk.

3. Select Account Currency

- Choose the currency of your Exness account to ensure accurate calculations, especially when trading currency pairs.

Interpreting the Results from the Exness Investment Calculator

1. Profit and Loss Estimations

- Explanation: The calculator estimates potential profit or loss based on variables like entry and exit prices, trade size, and leverage.

- Interpretation: Analyze whether a trade fits your risk/reward ratio and overall strategy. This insight is crucial for determining the viability of trades.

2. Risk Management Insights

- Explanation: The tool provides metrics like required margin and the impact of leverage on your trade.

- Interpretation: These metrics help you manage exposure effectively, ensuring you maintain appropriate risk levels and preserve capital over time.

3. Scenario Analysis

- Explanation: The calculator allows for the simulation of different trading scenarios by adjusting key variables.

- Interpretation: Use this feature to visualize potential outcomes and optimize your strategy to meet your trading goals.

Example: Using the Exness Investment Calculator

Let’s walk through a practical example of how to use the calculator for a forex trade on the EUR/USD pair.

Scenario

- Account Type: Standard

- Trading Instrument: EUR/USD

- Account Currency: USD

- Position Size: 1 lot (100,000 units)

- Entry Price: 1.1800

- Exit Price: 1.1850

- Leverage: 1:100

Steps

- Select Account Type: Choose ‘Standard.’

- Input Trading Instrument: Select ‘EUR/USD.’

- Set Account Currency: Choose ‘USD.’

- Enter Position Size: Input ‘1 lot.’

- Input Entry and Exit Prices: Enter ‘1.1800’ and ‘1.1850.’

- Choose Leverage: Select ‘1:100.’

Results

- Profit/Loss: With a 50-pip increase, the profit would be $500.

- Required Margin: With 1:100 leverage, the required margin would be $1,180.

- Pip Value: Each pip movement is worth $10 per standard lot.

Key Features of the Exness Calculator

- Profit Calculations

- Feature: Input entry and exit points to estimate profit or loss.

- Benefit: Helps set realistic profit targets.

- Risk Assessment

- Feature: Calculates margin requirements based on leverage.

- Benefit: Ensures effective risk management by preventing over-leveraging.

- Scenario Flexibility

- Feature: Adjust variables like leverage and position size to simulate different outcomes.

- Benefit: Tailor strategies to current market conditions.

The Exness Investment Calculator is a powerful tool that allows traders to make informed decisions by providing clear insights into profit potential, risks, and margin requirements. By interpreting results like pip value, leverage, and spread costs, traders can enhance their strategies and improve long-term trading success.

Exness Calculator vs. Traditional Methods

- Speed and Efficiency:

- Exness Calculator: Instantly computes key financial metrics like profit, loss, and margin requirements with minimal user input.

- Traditional Methods: Manual calculations using spreadsheets or other tools take more time and can lead to errors.

- Accuracy:

- Exness Calculator: Automatically factors in real-time market conditions, correct leverage, and specific instrument parameters, ensuring precision.

- Traditional Methods: Depends on the trader’s knowledge and understanding of market factors, increasing the likelihood of mistakes in complex calculations.

- Accessibility:

- Exness Calculator: Available online with no downloads required, making it easily accessible from any device.

- Traditional Methods: Often relies on physical tools or software that might not be accessible on the go.

- Comprehensive Analysis:

- Exness Calculator: Combines all critical financial metrics in one place, offering a complete view of potential trade results.

- Traditional Methods: Requires multiple tools or manual calculations for different aspects of trade analysis, making it harder to get an integrated view.

Integrating the Exness Calculator into Your Investment Strategy

- Pre-Trade Analysis:

- Use: Simulate various market conditions by adjusting price, leverage, and position size to predict trade outcomes.

- Benefit: Helps traders make informed decisions before entering a trade, improving the likelihood of success.

- Risk Management:

- Use: Regularly assess margin and leverage using the calculator to avoid overexposing any single position.

- Benefit: Ensures a balanced portfolio and minimizes the chance of significant losses from risky trades.

- Performance Review:

- Use: Compare calculated projections with actual trade outcomes to evaluate the effectiveness of your trading strategy.

- Benefit: Offers insights into your strategy’s performance, allowing you to make data-driven improvements.

- Strategic Adjustments:

- Use: Refine your trading tactics by using the calculator’s results to reduce leverage, adjust position sizes, or modify entry/exit points.

- Benefit: Proactive adjustments based on calculator insights help optimize long-term trading success.

- Educational Tool:

- Use: For novice traders, the calculator serves as a learning aid for understanding essential trading concepts like leverage, margin, and pip values.

- Benefit: This tool builds foundational trading skills, boosting confidence and competence as new traders progress.

FAQs About the Exness Investment Calculator

What is the Exness Investment Calculator?

The Exness Investment Calculator is a tool designed to help traders estimate potential profit, loss, margin requirements, and other financial metrics before executing trades. It provides a comprehensive view of trade outcomes based on user inputs like position size, entry and exit prices, leverage, and account type.